9543793034: Real Estate vs. Crypto – What’s Better?

The debate between real estate and cryptocurrency as investment choices continues to captivate investors. Real estate offers stability through property appreciation and rental income, appealing to those prioritizing security. Conversely, cryptocurrency presents a high-risk, high-reward landscape driven by market volatility and speculation. Understanding the nuances of each asset class is essential. As investors weigh their options, the question remains: which investment strategy will ultimately yield the best returns?

Understanding Real Estate Investments

Real estate investments represent a tangible asset class that has long been favored for its potential to generate stable, long-term returns.

Investors typically benefit from property appreciation over time, enhancing their overall wealth. Additionally, rental income provides a consistent cash flow, further solidifying real estate's appeal.

This combination of asset value increase and regular revenue stream aligns with the desire for financial freedom.

Exploring Cryptocurrency Markets

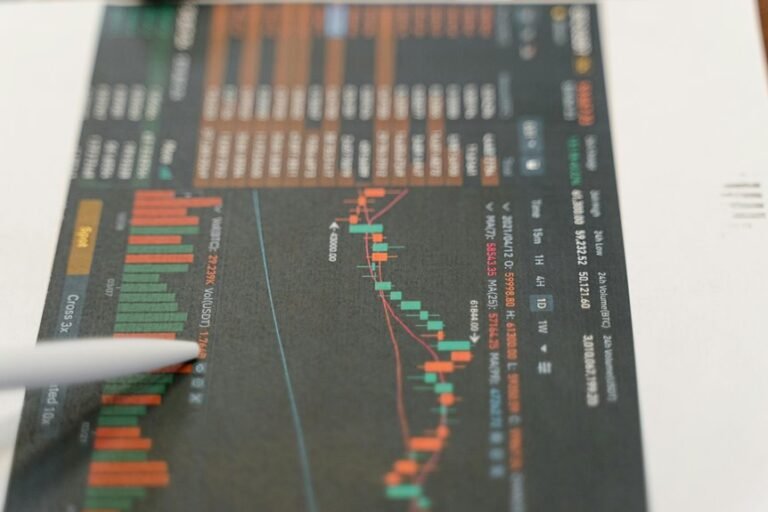

While traditional investment vehicles like real estate have established frameworks and predictable returns, cryptocurrency markets present a dynamic and rapidly evolving landscape that attracts both speculative and long-term investors.

The inherent crypto volatility creates opportunities for significant price fluctuations, driven by shifting market trends.

Investors must navigate this complexity, balancing potential gains against the unpredictable nature of digital assets in their pursuit of financial freedom.

Evaluating Risks and Rewards

Although both real estate and cryptocurrency offer potential for wealth accumulation, the risks and rewards associated with each investment differ significantly.

Real estate tends to provide stability and steady income, while cryptocurrency is characterized by high market volatility, presenting both opportunities and threats.

Investors may leverage both assets for investment diversification, balancing the steady returns of real estate against the dynamic potential of crypto markets.

Conclusion

In the investment landscape, real estate and cryptocurrency each shine like stars in a vast sky, offering unique benefits. Real estate serves as a solid anchor, providing stability and predictable income, while cryptocurrency dances with volatility, presenting opportunities for rapid gains. By blending these assets, investors can create a portfolio that balances risk and reward, ensuring a well-rounded approach to financial growth. Ultimately, the choice between the two depends on individual risk tolerance and investment goals.